It’s Phil…

Last week’s market action was like watching a cat decide whether to jump off a shelf—hesitation, commitment, regret, and then chaos.

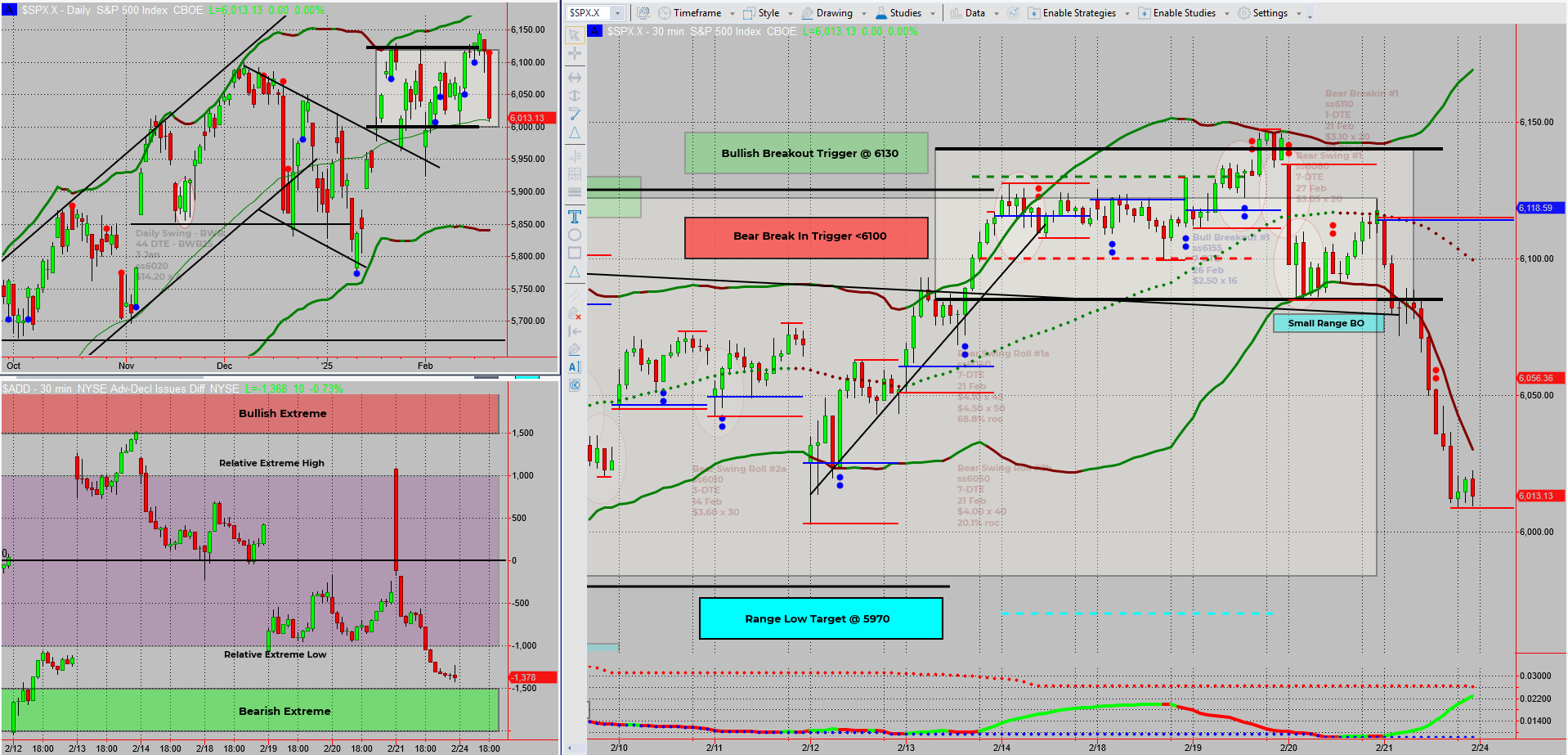

SPX pushed through the bull trigger on Wednesday, only to whip back through the hedge & bear trigger, finally showing some real movement on Friday. But before we get too excited, SPX is still stuck inside a larger range, with 6000 as the next key battleground.

Will we see a range breakout or another rejection?

Let’s dive in.

Deeper Dive Analysis:

SPX Moves – But Is It Just Another Range Play?

Last week gave us plenty of action, but SPX hasn’t truly escaped its larger range yet.

📌 What happened last week?

- SPX broke the bull trigger on Wednesday 🚀

- Immediately flipped back through the hedge & bear trigger 🤦♂️

- Friday’s move finally opened things up 🔓

Now, we’re eying 6000 as the next decision point.

📌 Two potential setups:

- ✅ Range Reversal – Price rejects 6000 and moves back inside the range

- ✅ Breakout Trade – SPX clears 6000, confirming a new leg up

Either way, I’ll be watching closely for the next trade setup.

VIX Says ‘No Crash… Yet’

📉 The volatility index (VIX) remains below 20, meaning:

- No imminent crash signals 🛑

- Fear is elevated but not panicking

- Still room for surprises, but not full-blown chaos (yet!)

If VIX jumps past 20 and keeps climbing, then we’ll talk about more extreme downside risk.

Overnight Futures – A Small Bounce, But No Turn Yet

🌅 Futures are slightly green, but they don’t confirm:

- A major bullish turn ❌

- A full-blown breakdown ❌

Right now, it’s more noise than signal.

What’s Next?

📌 I remain bearish on my income swing trades 📉

📌 Waiting for confirmation—either:

- Bullish reversal (v-shaped price action shift) 🔄

- Bearish breakdown (clean range break below 6000) 🚨

For now, it’s another waiting game—but one that could pay off big when the next major move arrives.

Fun Fact

📢 Did you know? In 2010, the Flash Crash wiped out nearly $1 trillion in market value in just 36 minutes, only to recover almost entirely by the end of the day. The culprit? A single trader’s algorithm running wild.

💡 The Lesson? Sometimes, market chaos isn’t about fundamentals—it’s just a rogue algorithm losing its mind.

Happy Trading,

Phil