It’s Phil…

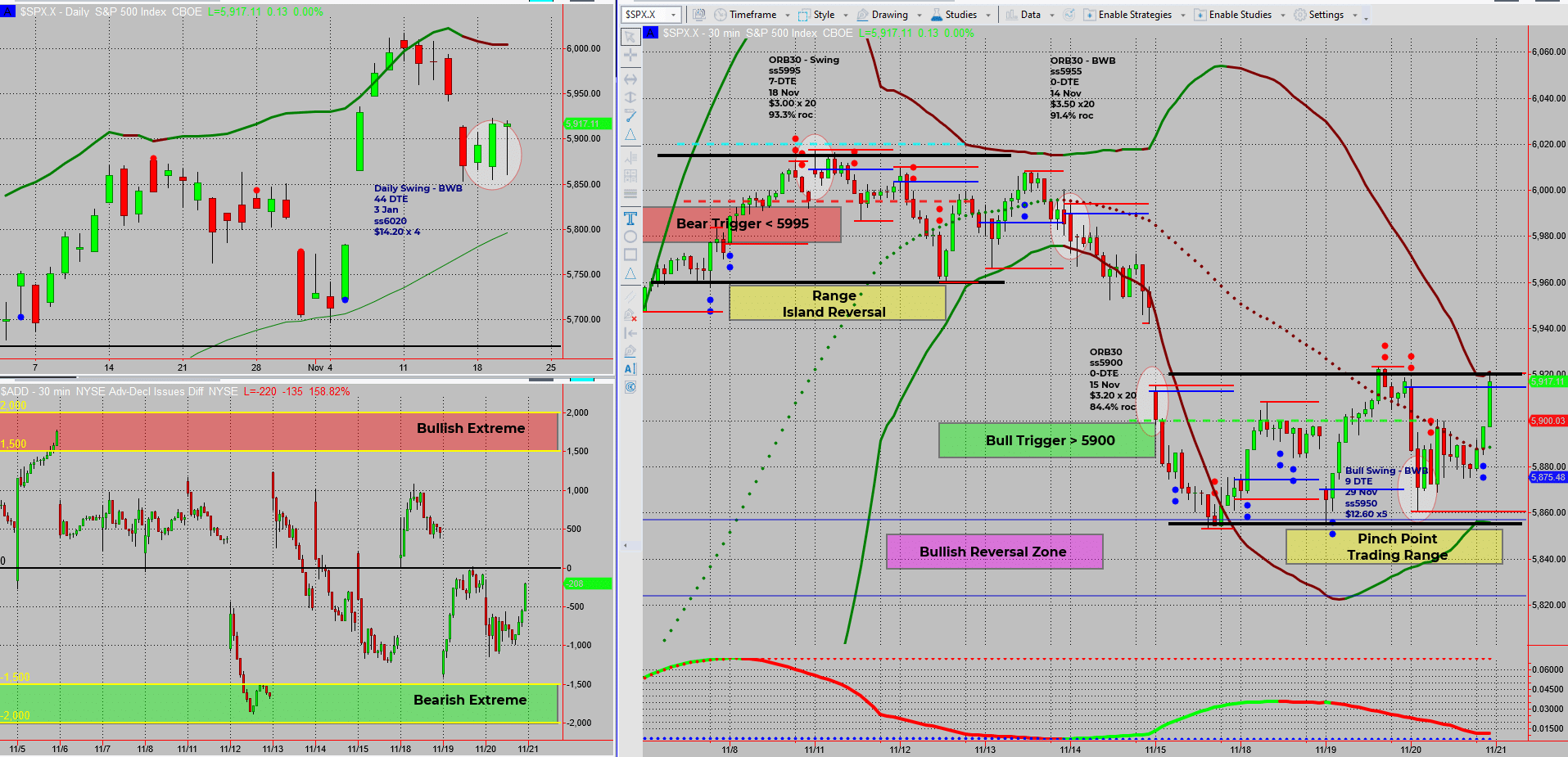

SPX is showing all the signs of settling into a consolidation phase, as indicated by my trusty custom Bollinger Band settings. For a change, I’m bullish this time around, but as always, my trading plan will adapt to whatever the market throws my way.

SPX is tightening up once again, showing a classic contraction phase. My Bollinger Bandwidth confirms this “pinch point,” signalling consolidation.

For a change, I’m approaching this with a bullish bias. In previous setups, I leaned bearish, but this time, the market’s story seems clearer.

Here’s the playbook:

- Option 1: Trade the range back and forth using my 6 Money-Making Patterns.

- Option 2: Hit pause on new entries and wait for a breakout.

This week’s round of news starts today and could stir things up. I’m expecting the current range to be short-lived, but I’ll trade what’s in front of me.

Long-term, I’m anticipating SPX to hit new all-time highs by the year’s end. This bullish trend should carry into next year, barring any major surprises.

Big Picture: Stay bullish, but let the setups dictate the moves.

Fun Fact

The SPX has hit new all-time highs every year for over a decade, except during major global crises. Markets, like life, love a comeback story.

This resilience shows that even during choppy times, the overall market tends to reward patience and a clear strategy.

Happy Trading,

Phil