It’s Phil…

The market is wound up tighter than a coiled spring, and I’m starting to wonder what will finally trigger the next move.

From a commentary standpoint, this is snooze-worthy—but from a trading standpoint, the Theta burn is quietly adding pennies to our pockets. Even if the market isn’t moving, we’re still getting paid.

Let’s break it down…

SPX Deeper Dive Analysis:

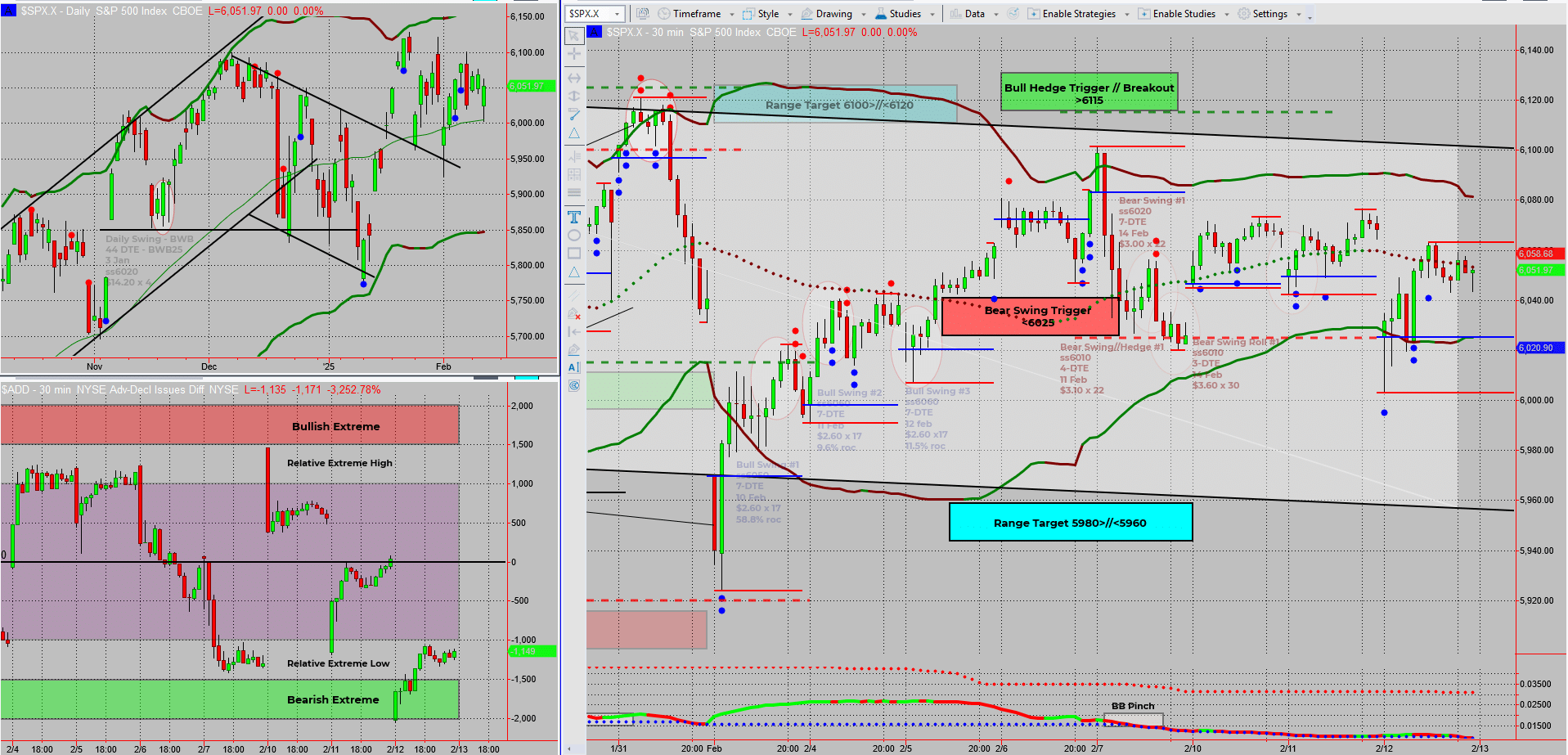

📉 SPX is Stuck – But That’s Not a Bad Thing

The market has been compressing into a tighter range, creating a pressure buildup that could snap in either direction. While traders watching for big swings are frustrated, we’re happily raking in Theta decay.

💰 Theta Burn – The Secret to Profiting in a Boring Market

- In choppy or sideways conditions, directional traders get wrecked

- But income traders get paid to wait, thanks to option decay

- Every day that passes without a move = profits added to our pockets

📌 Overnight Futures – Still No Directional Clues

- The futures market isn’t offering any strong signals 📉📈

- Price compression continues, across all indexes

🚀 What Happens Next?

- Eventually, this coiled spring will snap—we just don’t know when

- The key is patience—we don’t need a big move to win

- Whether SPX explodes up or down, we’ll be ready 💡

📌 Final Takeaway?

Sideways markets may be boring to talk about, but for income traders, they’re a steady payday. The key is knowing how to extract profits while waiting for the breakout.

Fun Fact:

📢 Did you know? The longest sideways market in history lasted nearly 17 years (1966–1982).

💡 The Lesson? Even in extended choppy periods, there are ways to profit—as long as you have the right strategy.

Happy Trading,

Phil