It’s Phil…

Early bird catches the premium! Tuesday kicked off with a sneaky new trade setup I’ve been testing—perfectly in line with the Tag ‘n Turn direction. Spoiler: it’s looking playbook-worthy!

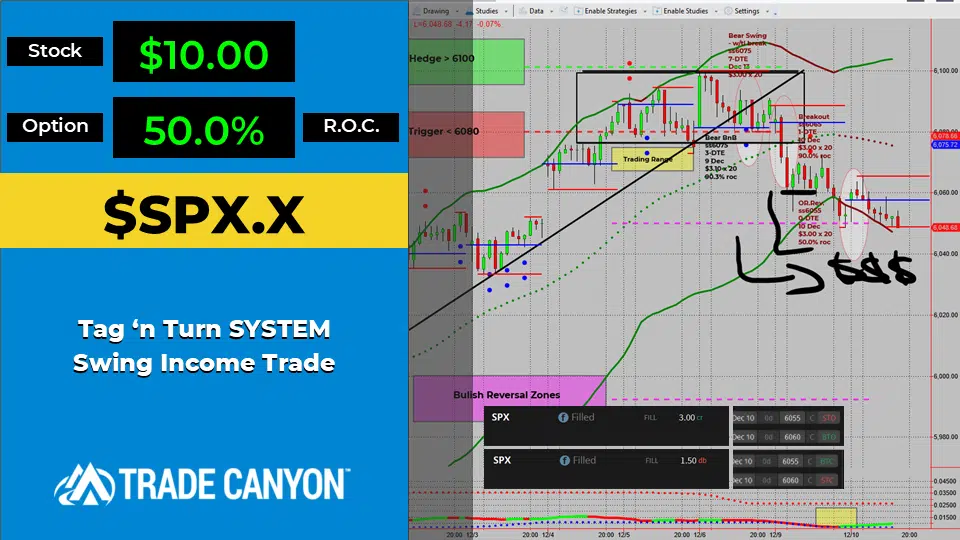

This morning, a new strategy sailed into testing waters—a false ORB setup perfectly aligned with Tag ‘n Turn’s overall direction. What happened next? Well, let’s just say lunchtime came with a 50% payday.

The day started with SPX presenting a juicy opportunity—a potential false breakout reversal. This new setup, currently under review for my strategy playbook, focuses on these moments:

- When price fakes out in the first hour of trading.

- Aligns with the broader Tag ‘n Turn direction.

With $3.00 in premium collected, the plan was simple: a quick in-and-out day trade.

By lunchtime, management rules (thanks to my trusty SPX playbook) prompted an early exit. The position was bought back for $1.50, locking in a 50% return.

The best part? All this happened while I was glued to my screen—not the trading charts, but The Jackle. Eddy Redmayne really knows how to steal the show.

Trading doesn’t have to mean stress. With solid setups and a mechanical system, you can profit with precision.

Fun Fact

SPX’s fastest recovery from a bear market was in 2020. It took just 33 trading days for SPX to recover 50% of its losses after the pandemic-driven crash in March.

Why it matters: This broke records and highlighted how market dynamics are shifting with technology and sentiment moving faster than ever.

Happy Trading,

Phil