It’s Phil…

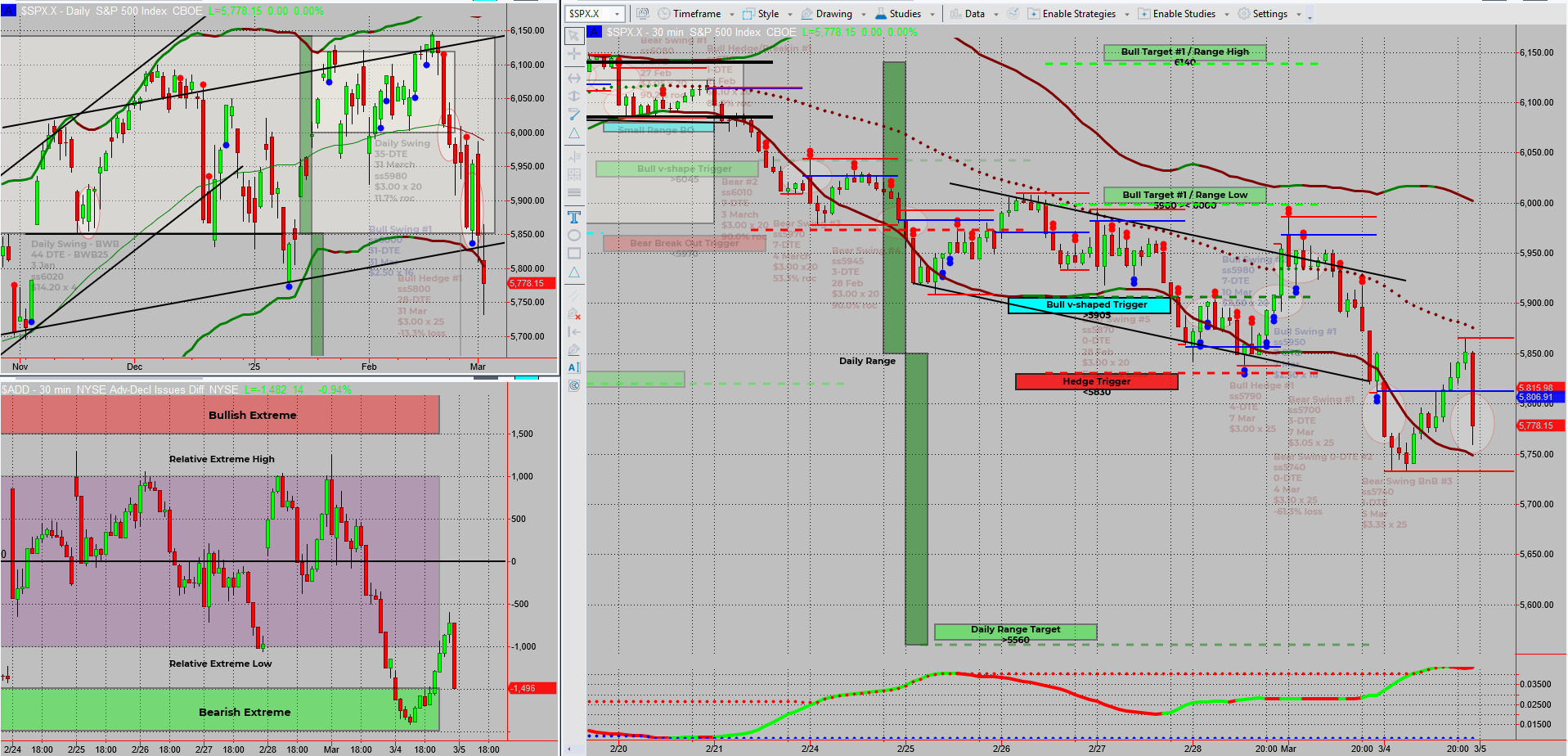

We expected roller-coaster swings this week, and the market hasn’t disappointed. The price action feels oddly familiar, reminiscent of early 2022, when a failed all-time high attempt led to a slow, choppy bear market.

Right now, the market is stuck at a key decision point—dithering at the lower range like it can’t decide whether to break down or bounce back up. ADD data leans slightly bullish, suggesting a possible range-bound chop with an upward bias, unless sellers take full control and push us into the February/March correction cycle.

No need to guess—I’m hedged and ready for either outcome. The only thing left to do? Wait for the market to tip its hand.

Deeper Dive Analysis:

The market is moving exactly as expected—lots of noise, little commitment, and price action that mirrors early 2022, just before the slow-motion bear market began.

📌 What’s Happening Right Now?

- Markets failed to make new highs and are now chopping near the range lows

- The last time we saw this structure? Early 2022 before a major shift downward

- Price is hesitating, signalling traders are waiting for a catalyst

📌 Two Possible Outcomes:

1️⃣ A Range Reversal (Bullish Scenario)

- ADD data suggests a short-term bullish bias

- A grinding, sideways move with an upward tilt is likely

- Ideal for small, quick trades—but no trend confirmation yet

2️⃣ The February-March Correction Cycle (Bearish Scenario)

- If support fails, sellers could accelerate the move lower

- Seasonal trends often bring a correction this time of year

- Watching for signs of a decisive breakdown

📌 How I’m Approaching This Market:

✅ Staying hedged so that a move in either direction is fine

✅ Being patient—waiting for a strong move before committing capital

✅ Avoiding impulse trades—letting the market tell me what’s next

Traders who rush in too early this week could get chopped up in the indecision, while those who wait for a clear confirmation will be in the best position to capitalize.

Fun Fact

📢 Did you know? The biggest one-day percentage drop in history wasn’t 2008—it was Black Monday in 1987, when the Dow crashed 22.6% in a single day.

💡 The Lesson? Markets can collapse out of nowhere, but structured traders with hedges and a system don’t panic—they profit.

Happy Trading,

Phil