It’s Phil…

Back on deck in good ole Blighty – the tan’s peeling, the jet lag’s fading, and the trading desk is live once more.

Last week reminded me (again) why we don’t force trades. Letting theta work, while fate and a few smart rules did the rest, turned what could’ve been a noisy Friday into a profitable cruise through the weekend.

📉 SPX’s story is only half the plot.

You’ve seen the SPX, but you’re missing the macro moves, crypto chaos, and the real reason gold’s stealing the spotlight..

⚡Get the daily newsletter – short, sharp, and brutally honest.

SPX Market Briefing

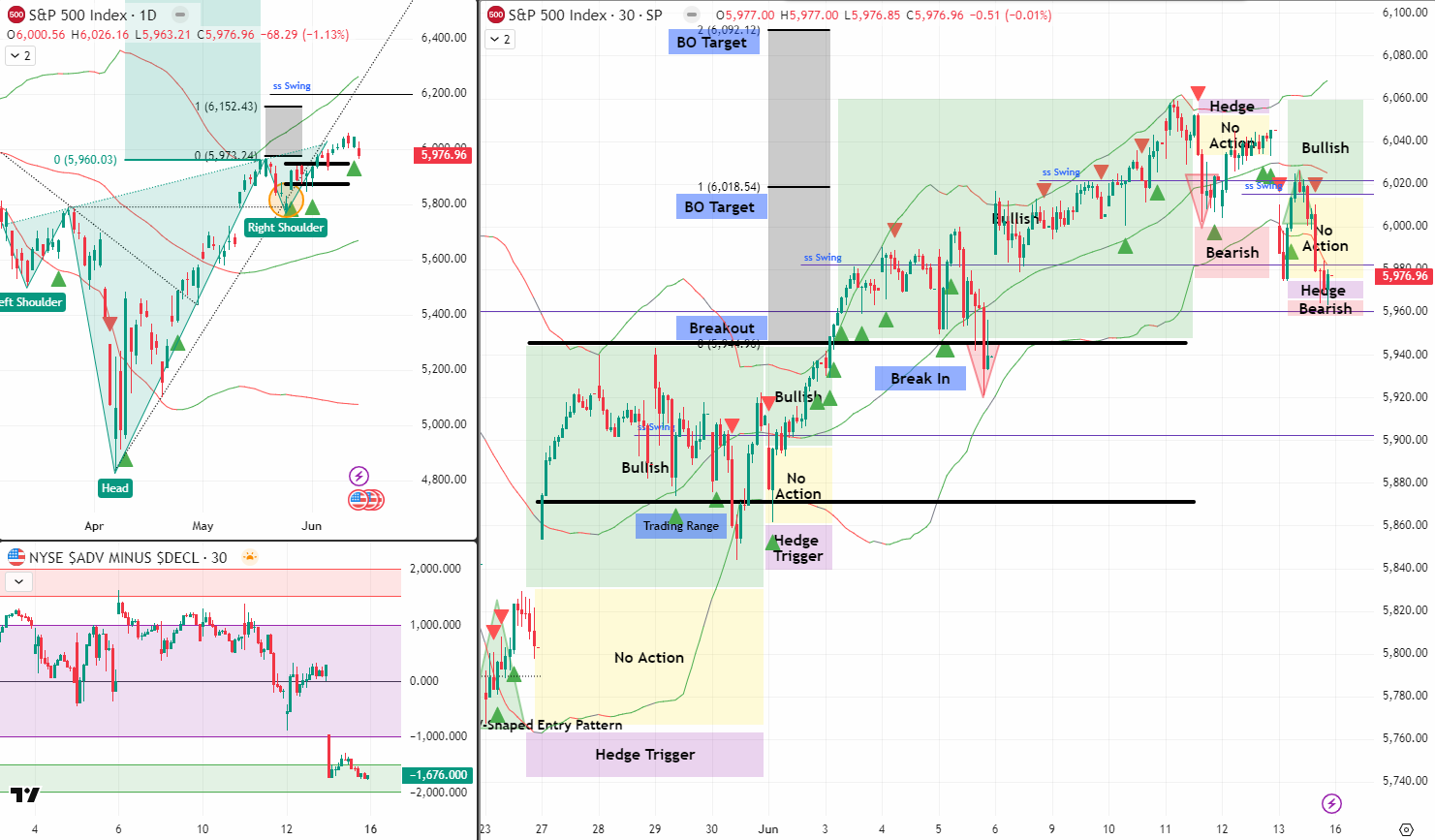

Friday’s late-session sell-off did nothing to shake my bullish swing positions. Mostly because I was mid-air and half-asleep, but partly because I’ve learned over the years not to rush anything.

I typically don’t open new trades late on Fridays – especially not after a solid week of setups. In this case, I had plenty of buffer, both technically and mentally, and chose to ride the weekend out.

That choice was reinforced by the Tag ’n Turn holding strong, a noticeable divergence between cash and futures, and a good old-fashioned review of historical war-driven market behavior. Spoiler: panic rarely lasts. In fact, it often gives way to strong bullish rebounds once clarity returns.

The “get paid to wait” mindset continues to be one of the biggest mental shifts for option traders. Whether the market’s a dime or ten dollars in our favor, we still profit from theta. Unlike traditional directional trading, our outcome isn’t tied to movement – and that’s the edge.

Coming into this morning, SPX futures are up 80+ points overnight. That wipes out Friday’s dip and sets the stage for possible cash-outs at the bell if swings hit target. And if not? We keep doing what works – wait, watch, and let time and structure do the heavy lifting.

Expert Insights

Mistake: Trading late Friday out of boredom or FOMO.

How to Avoid It:

Stick to a closing checklist. If the trade isn’t already proving itself by midday, don’t force it. Let the weekend sort the noise.

Fun Fact

Markets tend to rally in wartime?

Yep. The average post-conflict announcement performance of the S&P 500 shows +6% moves over 60 days following initial geopolitical shock events. Fear fades – money flows.

Happy Trading,

Phil

📉 SPX’s story is only half the plot.

You’ve seen the SPX , but you’re missing the macro moves, crypto chaos, and the real reason gold’s stealing the spotlight..

⚡Get the daily newsletter – short, sharp, and brutally honest.