It’s Phil…

We come into today’s session with a clear read – and a clean range.

Instead of relying on Bollinger Bands themselves, we’ve identified a bandwidth pinch and marked the charts using the range highs and lows from our money-making patterns.

It’s the same Tag n Turn logic you know – just anchored to structure levels instead of the bands.

That gives us better control and clear price thresholds to react to.

📉 SPX’s story is only half the plot.

You’ve seen the SPX, but you’re missing the macro moves, crypto chaos, and the real reason gold’s stealing the spotlight..

⚡Get the daily newsletter – short, sharp, and brutally honest.

SPX Market Briefing

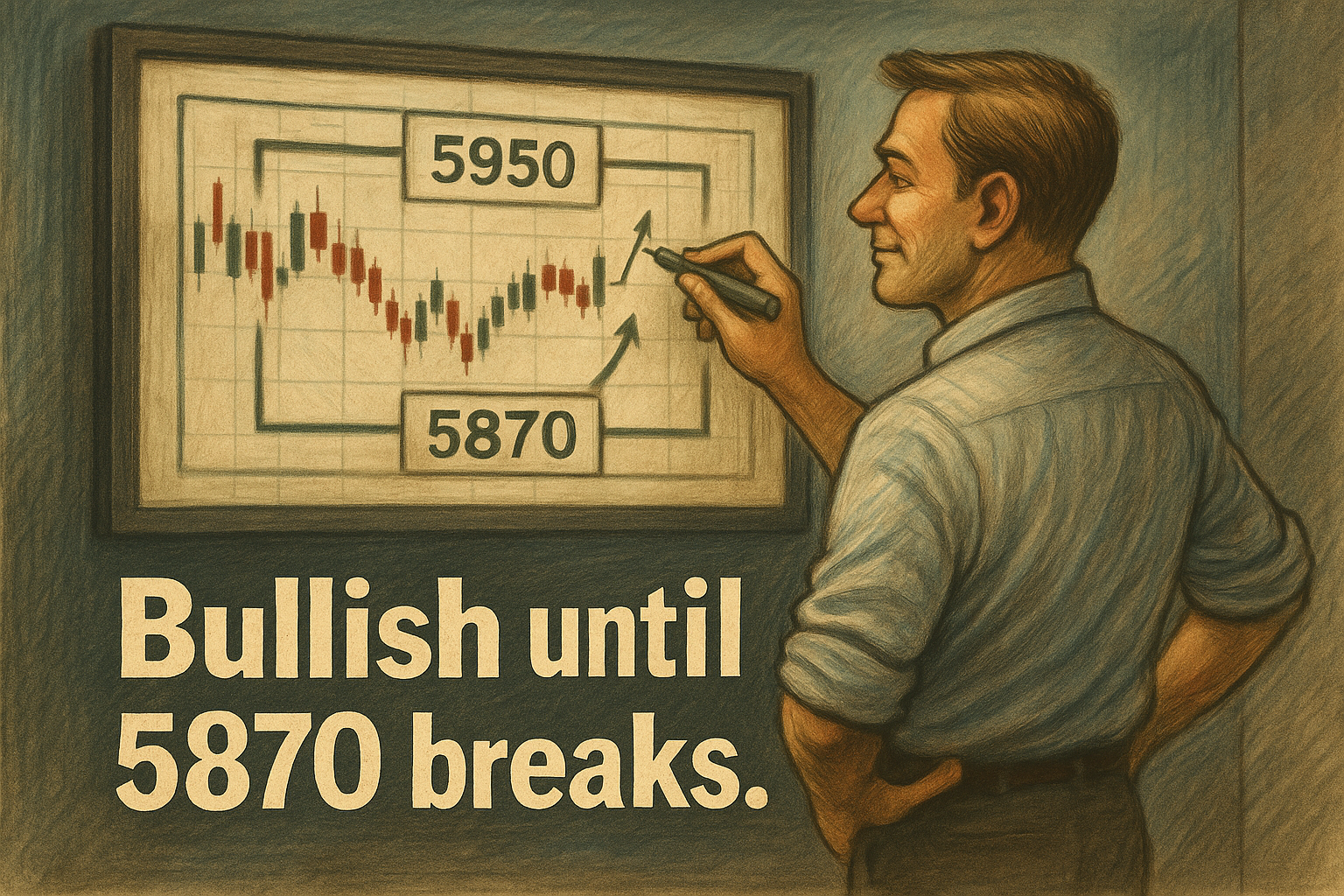

We’ll stay mechanically bullish until price proves otherwise – and today’s range gives us the two clean levels we need:

A breakdown below 5870 flips the system bearish

A breakout above 5950 confirms bullish continuation

Until one of those triggers?

The bias remains with the direction that brought us into the range, which historically resumes 65-70% of the time.

So we’re not pre-empting anything.

We’re not interpreting shadows.

We’re waiting.

We’re bullish until we’re not. And today, the chart will make that decision for us.

Expert Insights

Mistake: Abandoning Structure When the Bands Disappear

Too many traders toss the rules the moment the bands compress.

They assume “uncertainty” means “do something.” But that’s backwards.

All you need to do is swap tools:

Structure range replaces the bands.

Same pattern, same rules – just a sharper edge.

Fun Fact

Did you know?

Statistically, 65–70% of range breakouts resolve in the same direction as the move into the range.

In other words – don’t bet on the fakeout.

Bet on the follow-through, when the rules confirm it.

Happy Trading,

Phil

📉 SPX’s story is only half the plot.

You’ve seen the SPX , but you’re missing the macro moves, crypto chaos, and the real reason gold’s stealing the spotlight..

⚡Get the daily newsletter – short, sharp, and brutally honest.