It’s Phil…

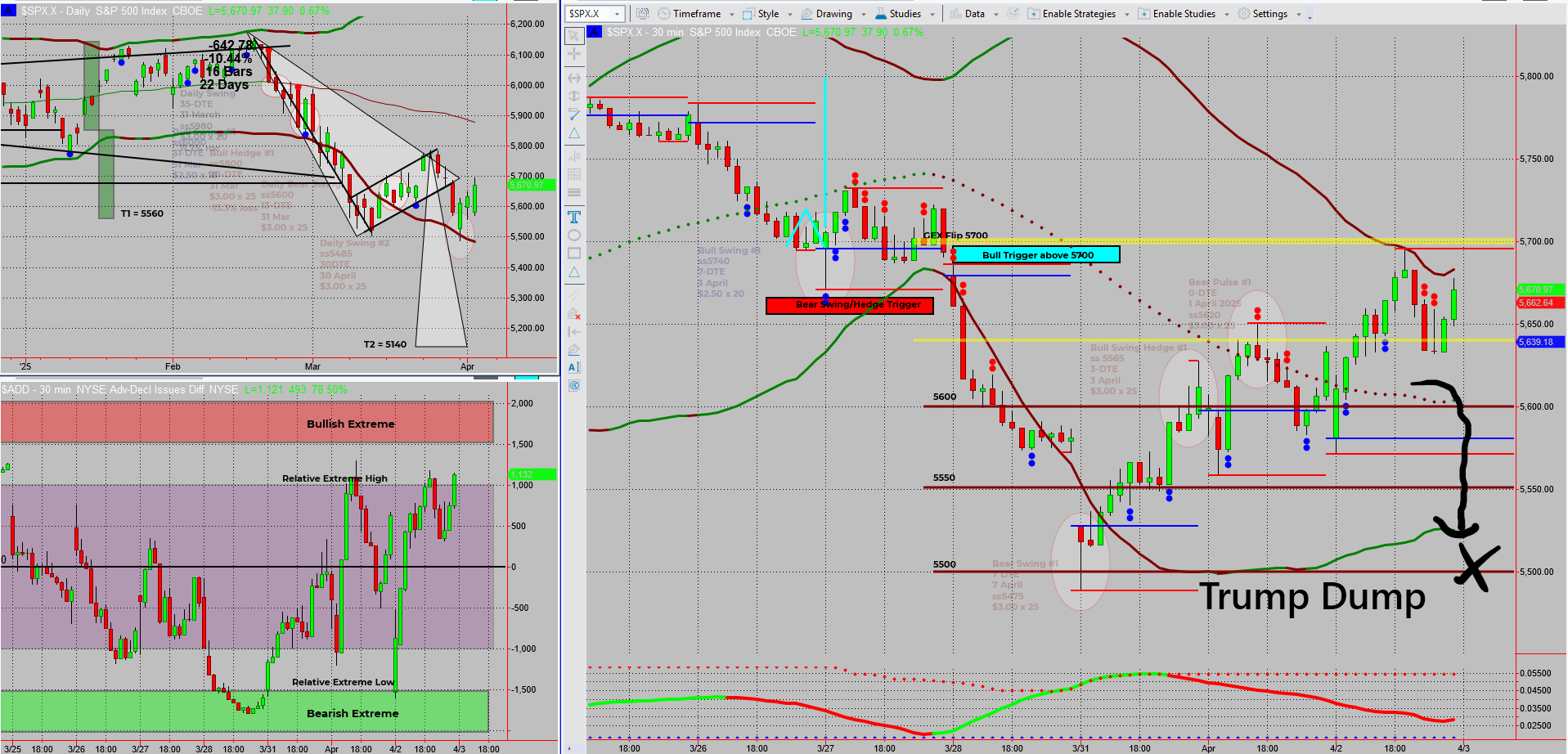

Well, we’re officially post-Trump-dump, and the market’s not exactly throwing a parade about it.

Futures have dropped nearly 200 points and are camped out near the lows as I write this. It’s shaping up to be one of those “big gap, big drama” mornings – the kind that rewards patience and punishes panic.

And while every headline’s now spinning a narrative about tariffs, Trump, and trade wars…

Our community was already leaning in the right direction:

Buy the rumour, sell the news. ✔️

No surprise here.

My discretionary override to stay bearish below 5700 is paying off.

No whim. Just discipline.

So, what’s next?

Simple. Stick to the plan.

Market Cracks, But I’m Not Calling a Collapse

Let’s get this out of the way first:

I don’t think this is the Big One.

No market apocalypse. No Armageddon. No bunker required.

This looks more like a tariff reset than total collapse – a sharp repricing, not a system failure.

But that doesn’t mean there’s no money to be made.

Far from it.

Here’s what I’m doing right now:

-

Bearish swings are active and in profit below 5700.

-

Aggressive add-ins under 5500 using:

-

Pulse bars

-

10-min Tag ‘n Turn setups

-

-

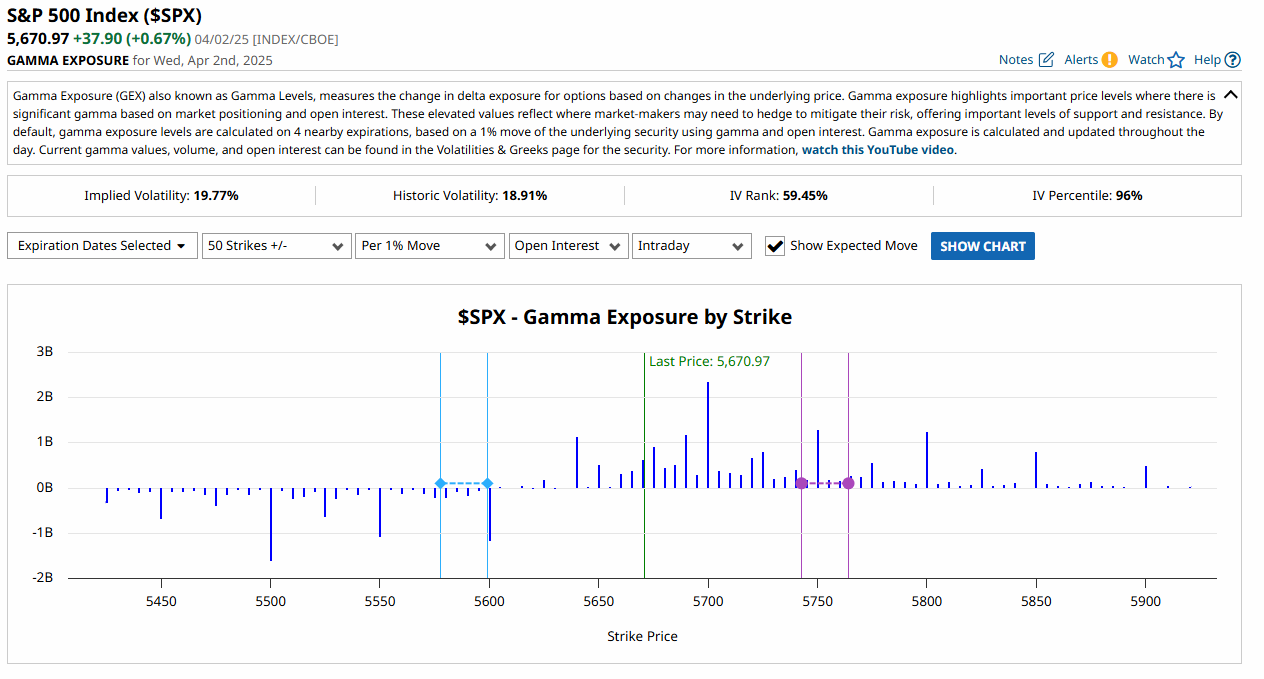

GEX flip has slid to 5640, but I’m still anchored at 5700.

-

Why? Because a few ticks don’t warrant overcomplicating.

-

-

I’ll reassess GEX levels at the open for any spicy shifts.

And importantly…

My bull swing hedge might finally be worth something – giving me room to de-risk last week’s exposure while continuing to profit on the downside.

GEX Analysis Update

- GEX flip has slid to 5640, but I’m still anchored at 5700.

🎯 Expert Insights – Don’t Change the Plan for Clickbait

Here’s what most traders get wrong on days like this:

❌ They abandon their bias because of headlines.

❌ They tinker with rules based on GEX micro-movements.

❌ They overreact to volatility instead of letting price confirm action.

What I’ve learned (the hard way, years ago):

✅ Structure matters more than spin.

If you had your levels mapped, this wasn’t a surprise.

✅ Your plan is only as good as your commitment to it.

Today is just another reason why I remain bearish until 5700 breaks.

✅ Reacting emotionally to news is a rookie mistake.

Today’s dump was just a fast-forward to what was already brewing.

🧠 Fun Fact

In 2018, when Trump first tweeted about tariffs, the market dropped over 1,100 points in a single session – then rebounded completely within 3 weeks.

Moral of the story?

Markets overreact. Patterns don’t.

Your job is to follow the pattern – not the press conference.

Happy Trading,

Phil