It’s Phil…

Earlier today I got a great question from James in the community:

“Phil, we've got a bull pulse candle for a zero-day, but with Trump talking at 9pm… would you stay out?”

Classic trader crossroads.

Bullish signal on the board.

But the orange wildcard is warming up the mic for prime time.

So… do we sit this one out? Or do we follow the system?

Here’s what I told James: “News doesn’t change the potential move – it usually just speeds things up.”

What To Do When The Headlines Loom Large

Let’s unpack this properly – because it’s something every trader wrestles with.

You’ve got two valid options on news-heavy days:

Option 1: Trade the system.

-

Tag ‘n Turn Swings and Pulse bar triggers? You’re in.

-

If it goes against you? You hedge.

-

The system doesn’t care who’s on stage – just what price is doing.

-

Stick to the rules. No emotions. No guesswork.

Option 2: Do nothing.

-

Feel uncertain? No shame in sitting it out.

-

Flat is a position.

-

Watching from the sidelines beats reacting to noise and wrecking your edge.

For me?

I’m still working with a discretionary override – I remain bearish below 5700.

That hasn’t changed.

And unless price changes that, Trump talking doesn’t either.

Expert Insights – Don’t Let News Trick You Into Overthinking

Here’s what I’ve learned after years of trading around Fed speeches, earnings drops, and political drama:

✅ News is rarely the cause. it’s the catalyst.

It speeds up the move that was already brewing.

✅ If you don’t have an edge on predicting the news, don’t try.

You’re not trading news. You’re trading structure, signals, and setups.

✅ Overreaction is the real danger.

The people panicking are often the ones who weren’t sure of their plan to begin with.

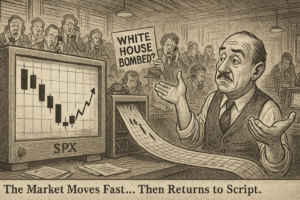

Fun Fact

In 2013, a fake tweet from a hacked Associated Press account claimed the White House had been bombed – and the Dow Jones dropped 150 points in two minutes.

The market recovered within three. But it proves the point:

News moves markets fast, but the direction was already wound like a spring.

Happy Trading,

Phil