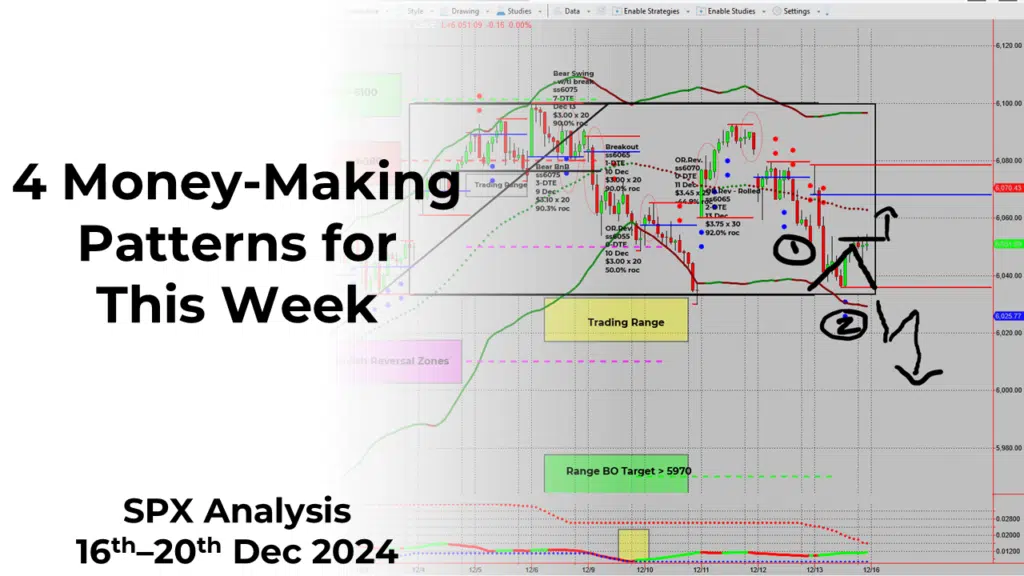

4Money-Making Patterns for This Week | SPX Market Analysis 16th – 20th Dec 2024

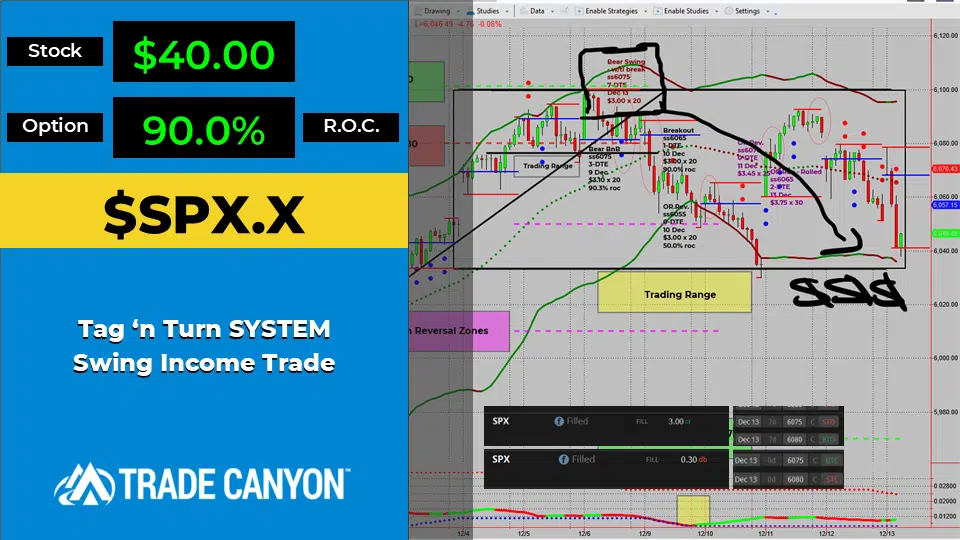

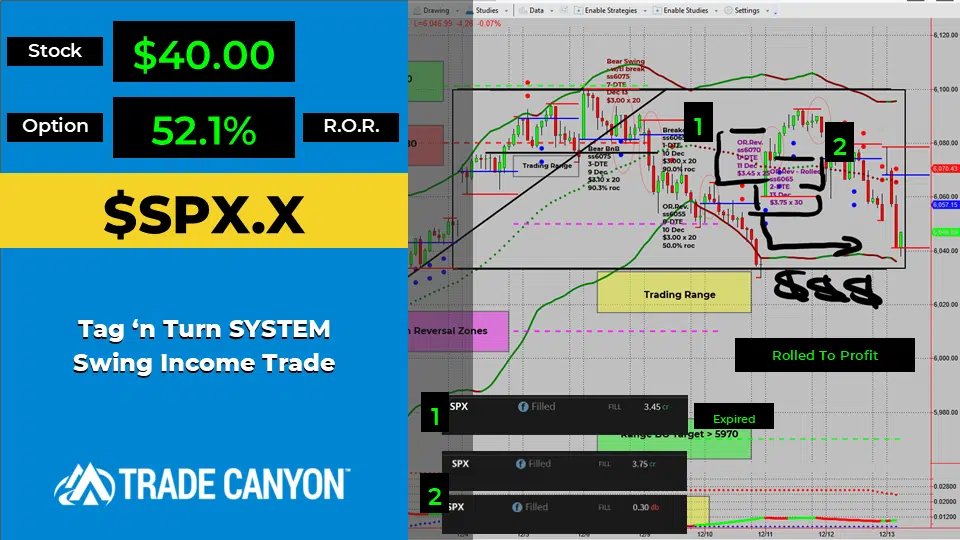

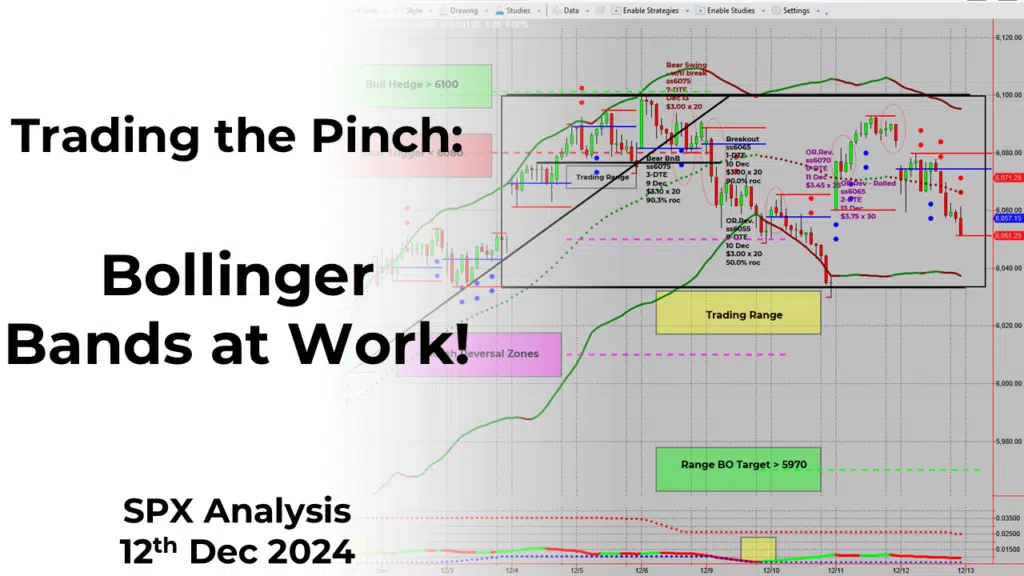

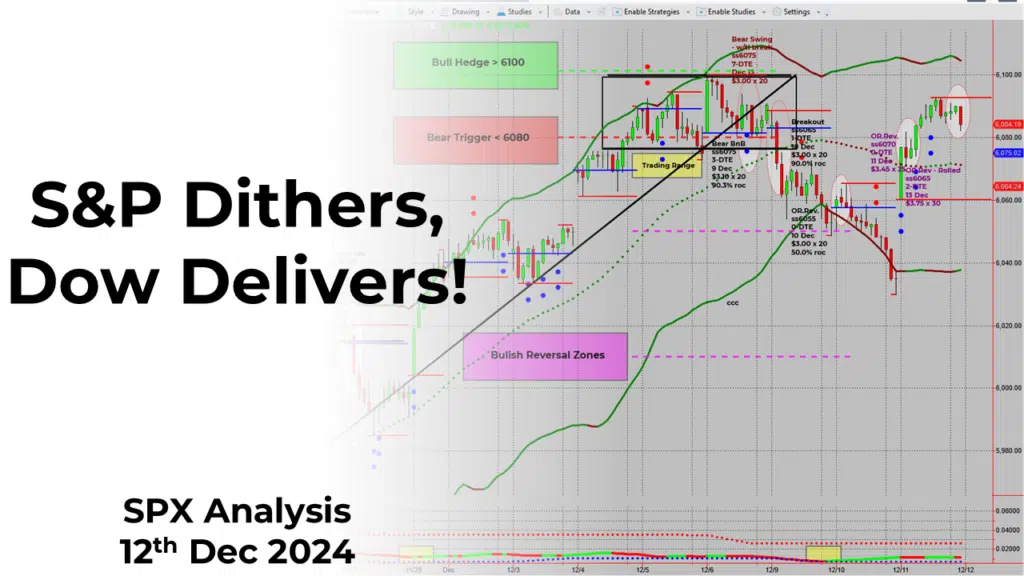

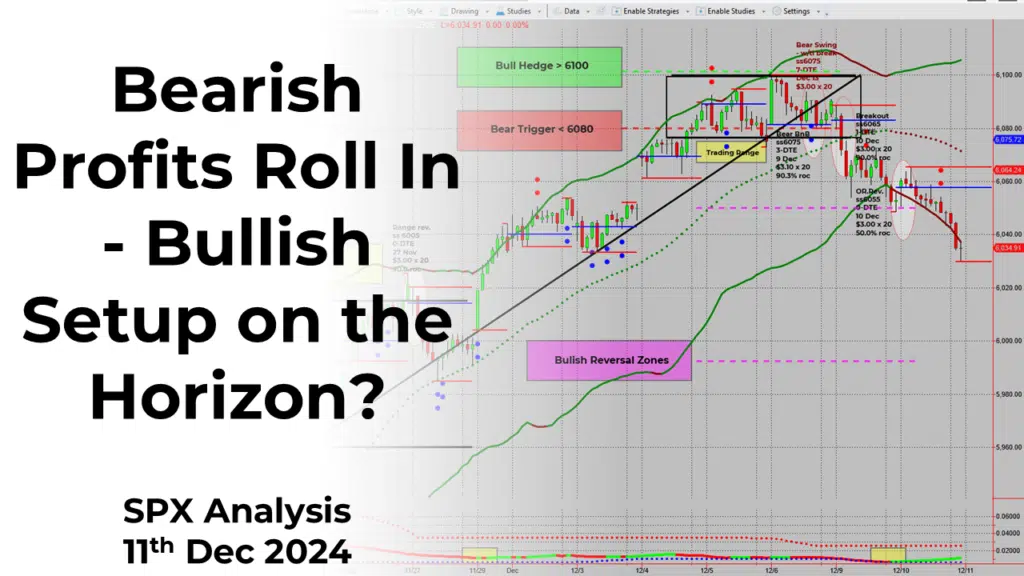

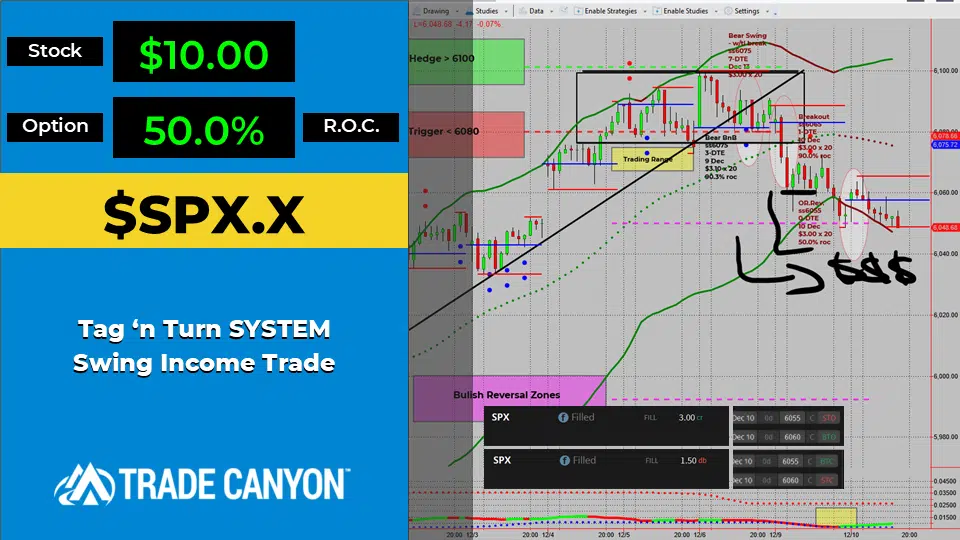

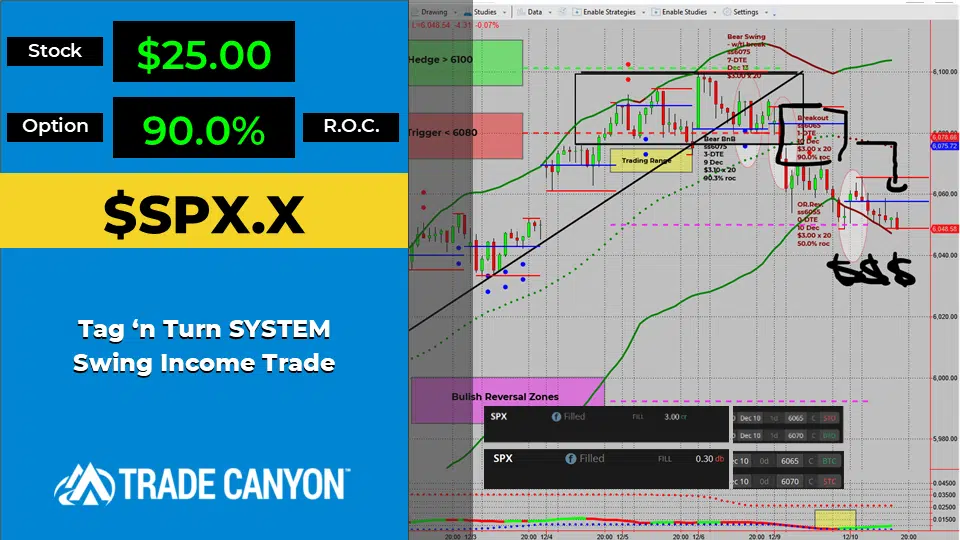

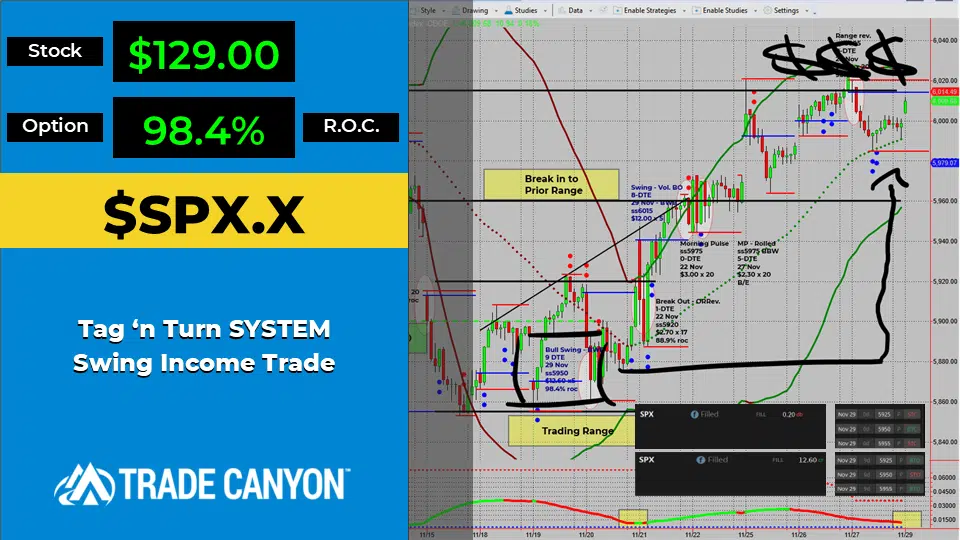

Ahoy there Trader! ⚓️ It’s Phil… Last week’s SPX Income trades delivered the goods, even without directional movement. That’s the beauty of this system—it works in all conditions! As we dive into next week’s opportunities, a clearly defined range opens the door for some lucrative setups. Let’s chart the course! SPX has set the […]

4Money-Making Patterns for This Week | SPX Market Analysis 16th – 20th Dec 2024 Read More »