“Badabada-Bing” into Friday as Plan Pays Again

It’s Phil…

TGIF.

This week, the muffins rose, the theta flowed, and we didn’t get “flip flopped” out.

Last week’s sideways chop made us sit tight.

This week? We capitalised.

And that’s the power of the system.

You don’t feel your way through the week.

You follow.

“Be bullish until we’re bearish.”

That’s it.

No need to guess.

No need to force flips.

We avoided one potential bear flip/flop midweek – and that’s not just a win… it’s a headache avoided.

📉 SPX’s story is only half the plot.

You’ve seen the SPX, but you’re missing the macro moves, crypto chaos, and the real reason gold’s stealing the spotlight..

⚡Get the daily newsletter – short, sharp, and brutally honest.

SPX Market Briefing: The Plan Didn’t Change (Because It Didn’t Have To)

From the Fast Forward group to the morning maps, everything aligned:

-

No bear confirmation below 6060

-

Breakout swing triggered above

-

6180 remains the projected measured move

-

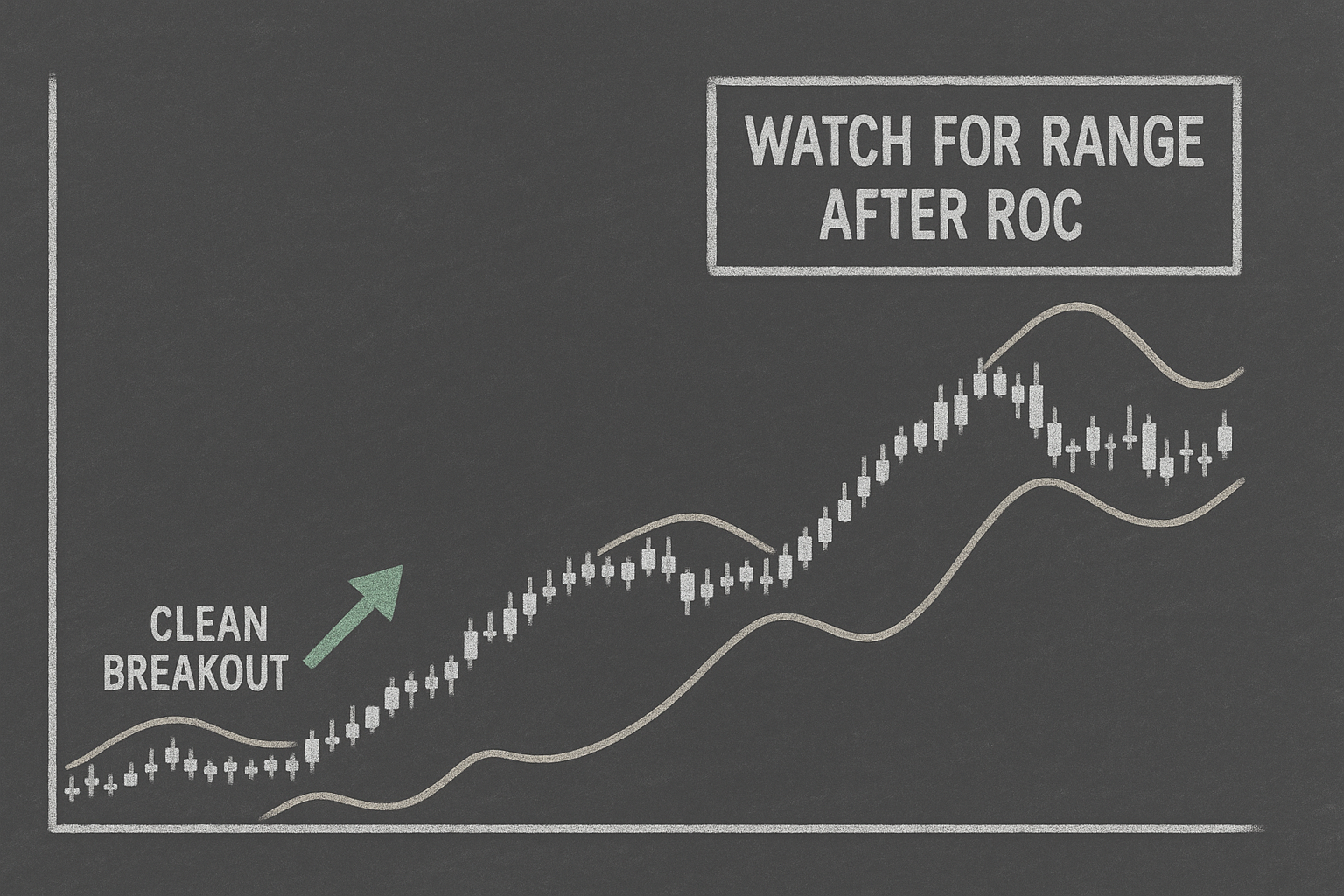

Bollinger Band width is now contracting – that’s your clue a pause or sideways drift may follow

We’ve already:

-

Scaled out of early swings

-

Reloaded on the breakout

-

Hit targets overnight with theta-rich structures

And today?

Friday’s plan = chill and hold structure.

There’s no need to guess the next move until we get the pause or reversal confirmation.

Until then?

Enjoy the song:

“Collect dat theta… badabada-bing.”

(Yes, that’s a Sean Paul remix if you squint hard enough.)

In Other News: Global Bull Buzz Meets Macro Calm

Mixed signals under market optimism

Opening note: Asia’s rally and a weaker dollar buoyed U.S. futures. The S&P edged +0.2%; Nasdaq ticked +0.3%.

Bridge sectors: Energy reversed early gains on the oil drop, while materials and industrials held modest strength. Export-linked names gained ground on FX tailwinds.

Next line: Tech stayed resilient-some chip names rebounded as AI momentum continued—while financials languished amid rising rate‑cut chatter. Gold miners slumped 1.2%.

Closing setup: Volatility remains restrained but poised. Investors await the core PCE data and Powell appearance next week. Key SPX level is 5,640 gamma. A break above could trigger a spring rally; a miss may prompt month-end rebalancing.

Expert Insights: Don’t Let a Pause Confuse You

You’ve heard me say it:

“Just because the market slows… doesn’t mean you need to.”

A narrowing Bollinger Band often signals a pending pause.

But that’s not a trade signal in itself.

It’s context.

And when you combine:

-

A directional breakout that hasn’t failed

-

A slow drift with no clear counter-structure

-

Profit in hand and premium collected

…then your job is done until price gives you a new signal.

This is how you avoid premature flips, emotional swings, and overtrading.

Read the tempo.

Don’t invent one.

Fun Fact: Lazy Friday ROC

A strong week doesn’t require a strong Friday.

In fact – strong Fridays usually come from not overtrading them.

This week we’ve already:

-

Cashed out overnight wins

-

Held breakout swing structures

-

Avoided chop

-

Preserved edge

Theta’s dripping.

The trade’s done the work.

So if you feel like today’s setup is “boring”?

Good.

That means the plan is working.

Happy Trading,

Phil

📉 SPX’s story is only half the plot.

You’ve seen the SPX , but you’re missing the macro moves, crypto chaos, and the real reason gold’s stealing the spotlight..

⚡Get the daily newsletter – short, sharp, and brutally honest.