It’s Phil…

Tariffs are back on the menu, and Wall Street’s not exactly throwing confetti.

Trump’s talking tough again, markets are wincing, gold is surging, and Bitcoin – being Bitcoin – couldn’t care less.

But me?

I’m grinning like the cat that shorted the cream.

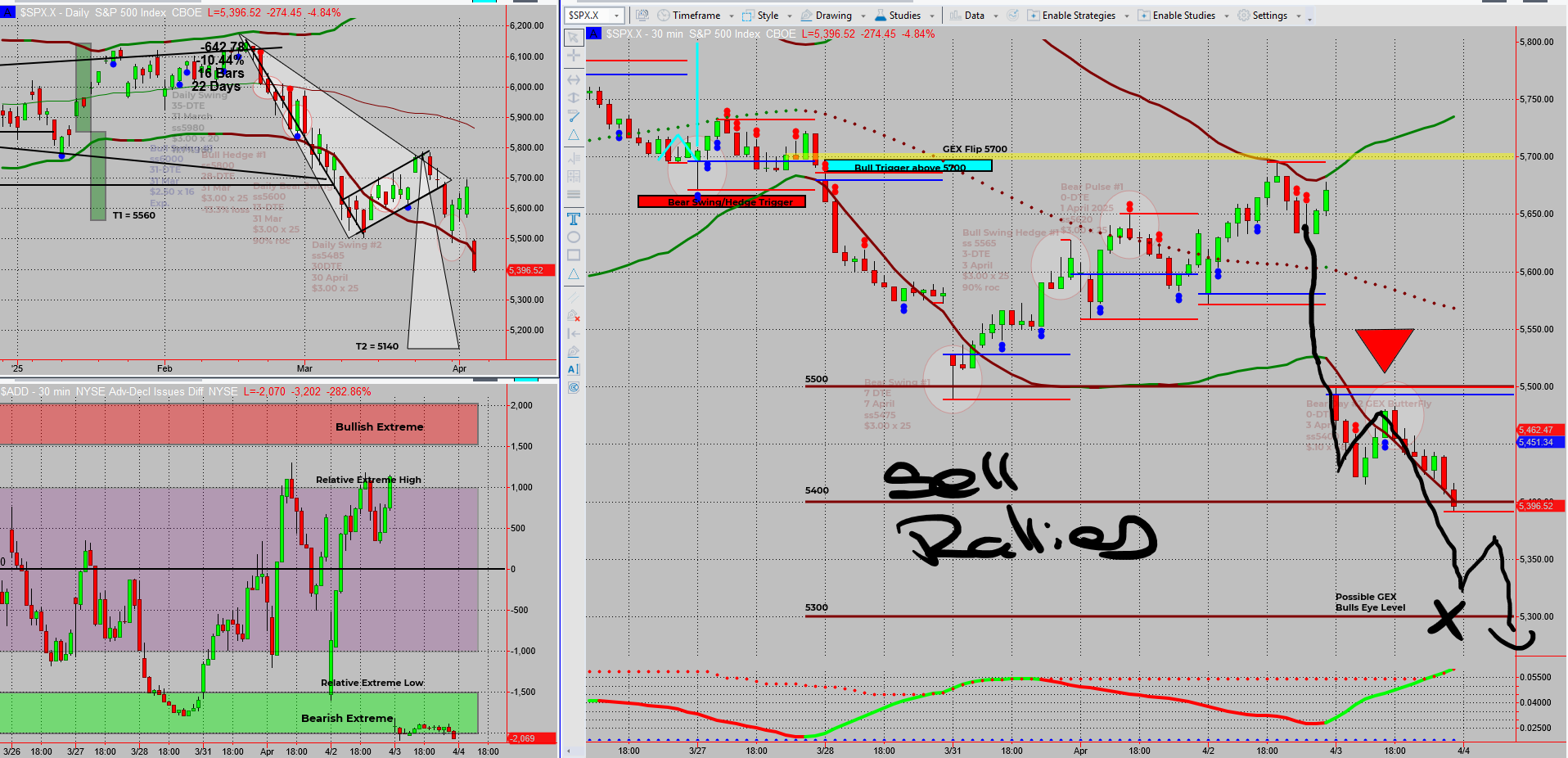

The plan said:

Stay bearish below 5700.

Get aggressive below 5500.

Add bear pulse bars and Tag ‘n Turn entries on any decent rally.

That wasn’t guesswork. That was structure.

And so far, it’s working like clockwork. ⏰

My income swings are ticking over nicely, I’m not rushing anything, and I’m sipping tea while stocks tumble. If we continue this slide into Friday, I’ll be adding more with a gleam in my eye and a sneaky Newton quote at the ready…

📉 SPX’s story is only half the plot.

You’ve seen the SPX, but you’re missing the macro moves, crypto chaos, and the real reason gold’s stealing the spotlight..

⚡Get the daily newsletter – short, sharp, and brutally honest.

Gravity's Pull – And A Little Newtonian Swagger

Overnight futures are down again – not panic-sell levels, but that smooth, sinister kind of selling we like to see when we’re positioned right.

If the market decides to tumble out the apple tree altogether?

You’ll hear me shouting:

“HOW DO YOU LIKE THEM THERE APPLES?”

And rightly so – because this isn’t luck.

It’s directional structure meets mechanical setups, seasoned with a little GEX wizardry.

Expert Insights – Trade the Plan, Not the Panic

When headlines scream, traders often get twitchy.

But this week is proving (again) that reaction is no match for preparation.

✅ Bear swings don’t need news. They just need structure.

✅ Sell the rallies – not your conviction.

✅ GEX often shows you where the market might want to pin – and when you can hit that sweet spot with a Bulls Eye butterfly, the payoff is huge.

The secret?

Plan the trade. Execute with structure. And don’t flinch.

Fun Fact

Sir Isaac Newton – the original gravity guy – lost over £20,000 (millions today) in the South Sea Bubble of 1720.

His famous quote?

“I can calculate the motion of heavenly bodies, but not the madness of people.”

He’d have loved the GEX data.

And probably traded options too.

(With a monocle. While sipping tea.)

Happy Trading,

Phil

📉 SPX’s story is only half the plot.

You’ve seen the SPX – but you’re missing the macro moves, crypto chaos, and the real reason gold’s stealing the spotlight..

⚡Get the daily newsletter – short, sharp, and brutally honest.