It’s Phil…

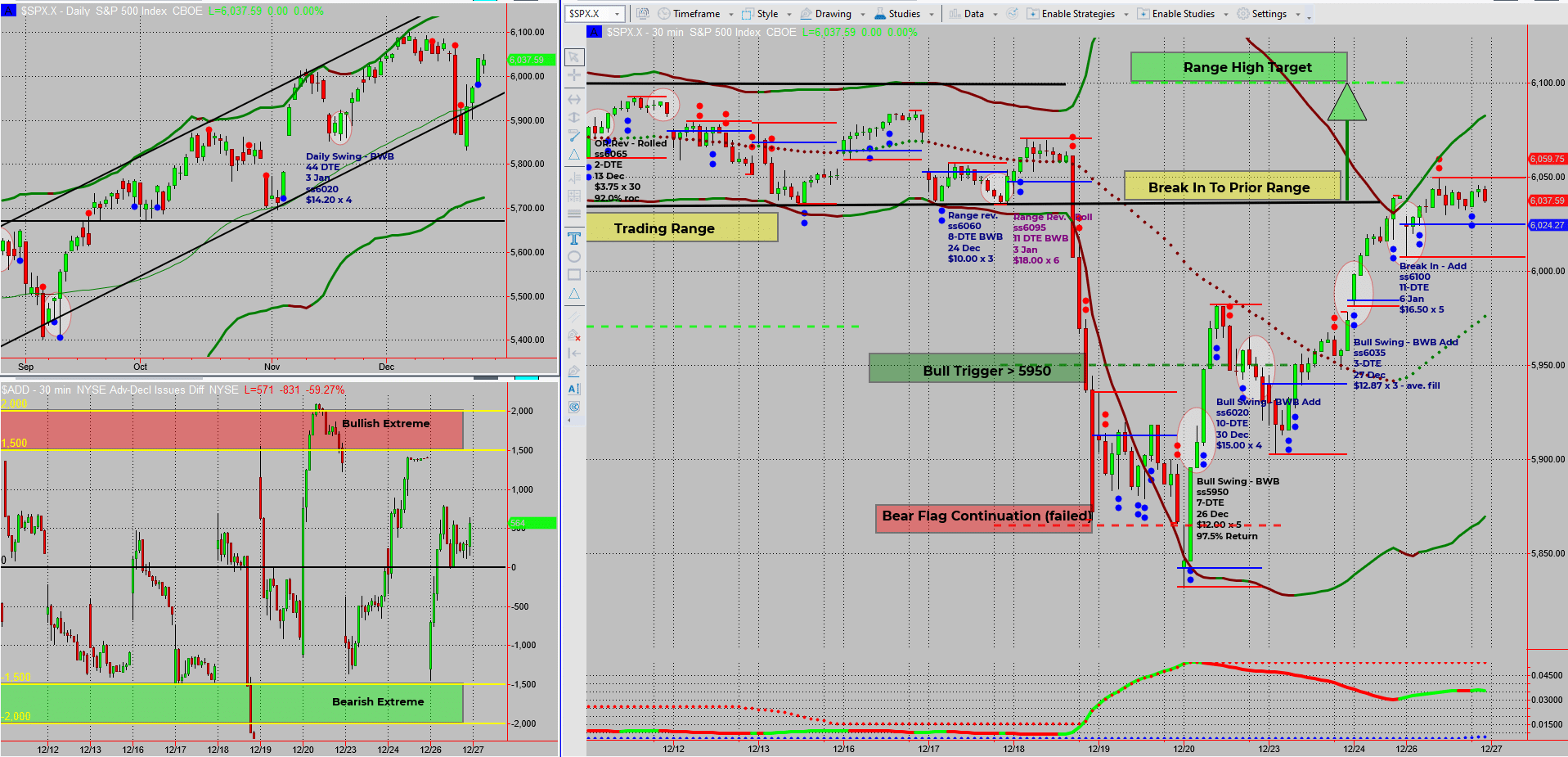

As we wrap up this shortened trading week, SPX has been doing its best impression of a hesitant climber—nudging against the prior range low but failing to secure a firm grip. Will we see a rip to new highs or a flip into bearish territory? Let’s dive into the action and plan ahead!

SPX remains at a critical juncture, brushing against the prior range low. Thursday’s session saw a “peekaboo” move inside the range, but there wasn’t enough momentum to lock in a decisive push toward the 6100 target.

- Bullish Momentum Slows:

- SPX climbed higher but with a lack of conviction.

- Overnight futures suggest another gap lower, mirroring Thursday’s early action.

- The Big Question: Rip higher or flip bearish?

- My bullish positions are building, benefiting from this lazy drift upward.

- A bearish pulse bar might tempt traders, but I’m holding off.

- The Game Plan:

- I’ll wait for a clean V-shaped reversal for bearish entries.

- Until then, my focus remains on bullish setups, delaying using the recent “Tag” part of the SPX system.

As we roll into the last trading day of the week, the setup favours more bullish moves unless bears roar in with conviction. Keep an eye on those pulse bars—they’ll confirm what’s next!

Fun Fact

Did you know that January is historically one of the strongest months for stocks? The “January Effect” often sees small-cap stocks rally as funds reposition portfolios for the new year. From 1928–2023, the S&P 500 has gained an average of 1.7% in January.

The January Effect is driven by a combination of tax-loss harvesting in December and reinvestment in January, particularly into small-cap and overlooked stocks. While this phenomenon isn’t guaranteed, it often sets the tone for the year ahead. Watch those small-caps—they might just surprise you!

Happy Trading,

Phil